Middle East fund managers favor United Arab Emirates stock markets over other bourses by a large margin as the region struggles with low oil prices and an unstable global environment, a monthly Reuters survey shows.

Gulf stock markets are in a difficult period as cheap oil slashes the state revenues of energy exporting countries and begins to tighten liquidity in banking systems.

But the survey of 15 leading investment firms, conducted over the past 10 days, shows them still prepared to put new money into UAE stocks. Some said the start of the reporting season for third-quarter corporate earnings in late October could be the trigger for such allocations.

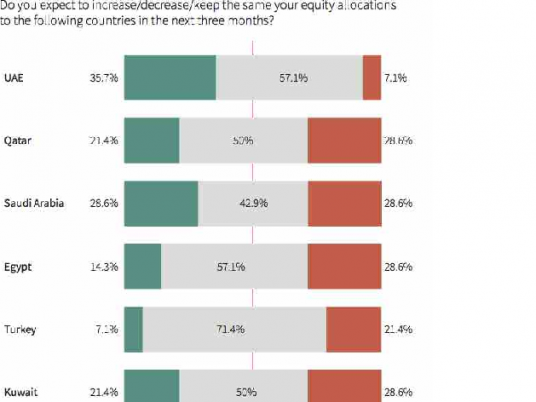

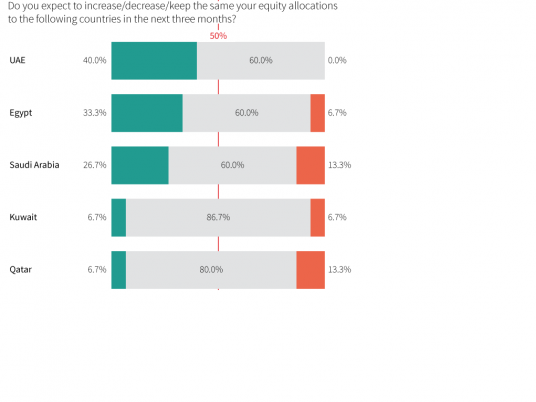

Fifty-three percent of fund managers in the latest survey said they expected to raise equity allocations to the UAE in the next three months, while none expected to cut them.

That was the biggest bullish balance for UAE equities since the survey was launched in September 2013. In the previous month's survey, 40 percent expected to raise allocations there and none to cut them.

Sebastien Henin, head of asset management at Abu Dhabi's The National Investor, said that after falls in recent months, the valuations of UAE stocks were attractive for the first time since 2012.

"The UAE has a diversified economy compared to the rest of the region – this is important with oil prices under pressure," he said.

Fund managers also cited expectations that Dubai, with close trading ties to Iran, would benefit from the lifting of international economic sanctions against Tehran in coming months, as well as the peg of the UAE dirham to the US dollar, which insulates foreign funds from the currency risk faced in many emerging markets.

Within the Gulf, the second most favored stock market is Saudi Arabia, but by a much smaller margin. Thirty-three percent of managers expect to raise equity allocations there and 20 percent to cut them; in the previous month, the ratios were 27 and 13 percent.

The Saudi market's heavy exposure to petrochemical industry earnings, which are sensitive to oil prices, and a lack of clarity over how the government will manage fiscal policy with oil so cheap remain major concerns for funds.

The latest survey also showed managers remained positive on Egypt despite that market's poor performance this year, with the Cairo index down 18 percent year-to-date.

Thirty-three percent of managers said they expected to raise allocations to Egyptian equities and none to cut them, compared to ratios of 33 and 7 percent in the previous month's survey.

The threat of depreciation of the Egyptian pound, delays in pushing through economic reforms and projects promised by the government, and domestic security worries have hurt the market. But Henin said many funds were still looking ahead to an uptrend in corporate profits and the promise of stronger economic growth.

"From a fundamental view, all the ingredients are there," he said.

Survey results

1) Do you expect to increase/decrease/keep the same your overall equity allocation to the Middle East in the next three months?

INCREASE – 5 DECREASE – 1 SAME – 9

2) Do you expect to increase/decrease/keep the same your overall fixed income allocation to the Middle East in the next three months?

INCREASE – 0 DECREASE – 1 SAME – 14

3) Do you expect to increase/decrease/keep the same your equity allocations to the following countries in the next three months?

a) United Arab Emirates

INCREASE – 8 DECREASE – 0 SAME – 7

b) Qatar

INCREASE – 3 DECREASE – 3 SAME – 9

c) Saudi Arabia

INCREASE – 5 DECREASE – 3 SAME – 7

d) Egypt

INCREASE – 5 DECREASE – 0 SAME – 10

e) Turkey

INCREASE – 1 DECREASE – 0 SAME – 14

f) Kuwait

INCREASE – 2 DECREASE – 0 SAME – 13

NOTE – Institutions taking part in the survey are: Ahli Bank Oman; Al Mal Capital; Al Rayan Investment LLC; Amwal Qatar; Arqaam Capital; Emirates NBD; Global Investment House; Invest AD; National Bank of Abu Dhabi; NBK Capital; Rasmala Investment Bank; Schroders Middle East; Securities and Investment Co of Bahrain; The National Investor; Union National Bank.