Middle East fund managers have become slightly more positive on regional equities after valuations fell, and more bearish on bonds because of a looming US interest rate hike, a monthly Reuters survey shows.

The survey of 14 leading fund managers, conducted over the past week, found 29 percent expecting to raise their regional equity allocations in the next three months, and 21 percent expecting to cut them.

That was a shift from last month's survey, when 21 percent anticipated reducing their regional equity allocations and 7 percent expected to raise them.

Improved valuations in several markets are the main reason; since last month's survey was published, stocks have fallen sharply in many bourses. In Dubai, for example, the main equities index has dropped 9 percent.

"Continued low oil prices have depressed valuations because stock prices have come under pressure, making them fundamentally attractive to medium- and long-term investors," said Mohammed Ali Yasin, head of securities at National Bank of Abu Dhabi.

Meanwhile, 36 percent of fund managers expect to reduce their allocations to fixed income and only 7 percent to increase them – the biggest bearish balance for fixed income since the survey was launched in September 2013.

Last month, 14 percent expected to cut their fixed income allocations and 7 percent to raise them.

The anticipated start of US monetary tightening in December is one reason. In addition, smaller flows of oil money through Gulf banks are tightening liquidity and pushing up short-term interest rates, reducing the buying interest which supported Gulf bond prices over the past several years.

This buying support has been dented further by the deterioration of Gulf governments' budget positions, which has made foreign investors more wary of regional debt.

"Current yields as well as the pace of the Fed rate hikes during the coming couple of years will dictate the rebalancing of funds amongst asset classes," said Tamer Kamal, head of asset management at Abu Dhabi-based Union National Bank.

Stock markets

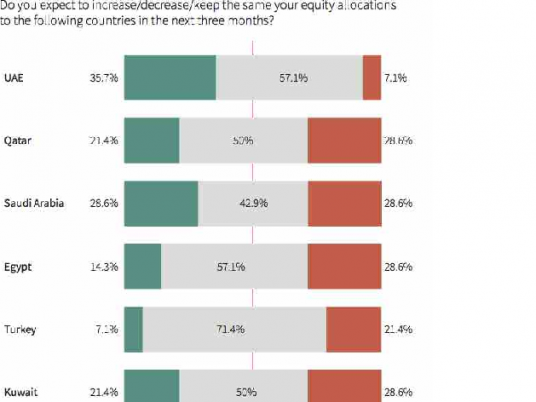

The United Arab Emirates remains the favored equity market among regional bourses with 36 percent of fund managers expecting to increase their exposure there and 7 percent to reduce it. That compared with levels of 50 percent and 7 percent last month.

"The general view is to overweight countries which offer good economic fundamentals," said Sebastien Henin, head of asset management at The National Investor in the UAE.

He noted that the UAE had provided more clarity about how it would cope with an era of cheap oil than other countries in the region. Elsewhere in the Gulf, governments have been less proactive and less transparent in policy.

Saudi equities are split between bulls and bears, with 29 percent expecting to increase allocations there and 29 percent to reduce them. Last month, there was an equal balance of 36 percent on each side.

Saudi valuations have not improved significantly since last month, and the Saudi government has still not announced details of its strategy to stabilise state finances in an era of cheap oil, so many fund managers said they would largely take a wait-and-see stance towards Saudi equities until the finance ministry releases its 2016 budget in December.

Meanwhile, funds have on balance turned bearish towards Egyptian equities because of the country's foreign exchange crisis, which threatens a currency devaluation, and disappointment with the pace of economic reforms.

Twenty-nine percent of managers expect to cut their allocations there and 14 percent to increase them – the most bearish balance since the survey was launched. Last month, the balance towards Egyptian equities was positive.

Funds have also on balance turned negative on Turkish equities because of geopolitical tensions following Turkey's downing of a Russian warplane, and because of concern about economic reforms after the AK Party's victory in elections.

Survey results

1) Do you expect to increase/decrease/keep the same your overall equity allocation to the Middle East in the next three months?

INCREASE – 4 DECREASE – 3 SAME – 7

2) Do you expect to increase/decrease/keep the same your overall fixed income allocation to the Middle East in the next three months?

INCREASE – 1 DECREASE – 5 SAME – 8

3) Do you expect to increase/decrease/keep the same your equity allocations to the following countries in the next three months?

a) United Arab Emirates

INCREASE – 5 DECREASE – 1 SAME – 8

b) Qatar

INCREASE – 3 DECREASE – 4 SAME – 7

c) Saudi Arabia

INCREASE – 4 DECREASE – 4 SAME – 6

d) Egypt

INCREASE – 2 DECREASE – 4 SAME – 8

e) Turkey

INCREASE – 1 DECREASE – 3 SAME – 10

f) Kuwait

INCREASE – 3 DECREASE – 4 SAME – 7 Institutions taking part in the survey are: Ahli Bank Oman; Al Mal Capital; Al Rayan Investment LLC; Amwal Qatar; Arqaam Capital; Emirates NBD; Global Investment House; Invest AD; National Bank of Abu Dhabi; NBK Capital; Schroders Middle East; The National Investor; Union National Bank; Rasmala Investment Bank.