Lebanon has been known as “the Switzerland of the Middle East” for decades because of its strict banking secrecy laws. But as the country falls ever deeper into economic crisis and debt, the banks that once drew so much foreign capital to the country are also in trouble.

Local economists estimate that altogether, Lebanese banks owe over $90 billion (€77 billion), and say that since late 2019, they have severely restricted withdrawals and foreign transfers, especially in US dollars.

There have been many stories about the financial damage done to ordinary Lebanese by these moves as their currency goes into free fall. The Lebanese pound has lost over 85 percent of its value against the US dollar on the black market.

But could potentially insolvent Lebanese banks also spark a dangerous, regional domino effect, causing the same sort of problems for the Middle East as an indebted Greece did for the European Union during the 2008 financial crisis?

Billions lost

Late last year, Syrian dictator Bashar Assad blamed his country’s ongoing economic woes on the fact that anywhere between $20 billion and $42 billion belonging to Syrian depositors was trapped in Lebanon. Syrian businesspeople have long used Lebanese banks to avoid international sanctions and other restrictions.

Earlier in 2020, research by a Yemeni think tank, the Sanaa Center For Strategic Studies, suggested that as much as 20 percent of Yemen’s foreign currency reserves, estimated at around $240 million, were stuck in Lebanese banks.

And in the semi-autonomous northern Iraqi region of Kurdistan, politicians claimed that up to $1 billion of money from oil sales was trapped with Lebanon’s Bankmed.

Lebanon cannot pay those debts

It is already clear that billions of dollars may never be recovered because Lebanese banks simply don’t have the funds to pay out to depositors.

In August 2020, the country’s central bank said that local banks had six months to raise the amount of capital they were holding to 20 percent. This capital includes the assets — the cash and stocks in a bank’s possession — it can use to withstand a crisis. For comparison, banks supervised by the European Central Bank had a capital ratio of about 15% in 2019.

Lebanese central bankers said that if local banks didn’t raise the cash, the government would take them over or force them to exit the market. In response, some Lebanese banks have sold subsidiaries in other countries, including in Egypt and Jordan, and there have also been layoffs in the Lebanese banking sector, which employs around 25,000 people.

However, that February 2021 deadline has passed, and neither the required increase in capital — worth an estimated $4.1 billion — nor the bank liquidations happened. The Lebanese banking crisis continues. It’s like watching a “train wreck in slow motion,” Lebanese economics columnist, Dan Azzi, wrote this month.

New money for old debts

Governments and businesses in the Middle East deposit their money in Lebanese banks for a number of reasons. They include the county’s strict banking secrecy laws and tax exemptions and the fact that, for years, local banks were offering inflated interest rates on US dollar deposits in order to lure more depositors in.

As the specialist publication International Banker reported, “the period following the financial crisis saw Lebanon being one of the very few countries to offer investors highly attractive rates of return … This made the small Middle Eastern nation a magnet for wealthy investors from around the world.”

“Many qualified this system as a Ponzi scheme where new money borrowed serves to pay old debt,” Rym Ayadi, a professor at London’s City University business school and head of the Euro-Mediterranean Economists Association, told DW.

As a result, Lebanon has ended up with one of the world’s highest debt-to-GDP ratios. This number compares what a country produces, the gross domestic product, with its ability to pay back what it owes. Lebanon’s is estimated at around 172 percent for last year. In other words, the country earned around $18 billion in 2020 but owes about $93 billion. Among developed economies, only Japan and Greece score worse.

Just like the 2008 financial crisis?

Having lent depositors’ money to the government and the central bank in various forms, private banks hold most of Lebanon’s public debt. So how dangerous is all this for other countries in the Middle East?

It won’t be like Greece and the EU, argues Khaled Abdel-Majeed, a fund manager with UK-based investment adviser SAM Capital Partners. “The countries it has primarily impacted are Lebanon and, to a lesser degree, Syria. I would say it’s primarily individuals and companies that have been affected by this debacle.”

Abdel-Majeed has been working in the region for over 27 years and personally knows of several individuals with between $200,000 and $500,000 stuck in Lebanese banks. He also knows of a Dubai-based company forced to write off around $8 million in 2020 because they couldn’t get it out of Lebanon. “It was a lot but not large enough to put that company at risk,” he said.

The Middle East moves on

“Lebanon’s financial system is too localized [to impact many other countries],” agreed Mike Azar, an analyst based in Washington and former lecturer in international economics at the John Hopkins School of Advanced International Studies. “There certainly has been an impact on many non-Lebanese individuals and companies, but it is limited and not systemic. Instead, the region is moving on without Lebanon.”

The fact that banks are selling off regional subsidiaries isolates them even further, financial systems specialist Ayadi confirms. “Lebanese banks are obviously becoming risky counterparts regionally and worldwide, and this makes them even further disconnected from the international system,” she said.

Imminent collapse, no compromise

Abdel-Majeed believes that depositors may eventually get a small fraction of their money back, although who gets what will be a political decision. Like many others inside and outside the country, he worries about what comes next. He notes that the institutions who could possibly bail Lebanon out of the financial crisis, such as the International Monetary Fund or the World Bank, say they won’t do so until there are significant reforms.

These reforms “basically upend existing power structures,” Abdel-Majeed told DW. “So that’s going to be difficult. My guess is that the situation will drag on for some time until either the country collapses completely, or the powers-that-be realize that unless they compromise, they’re going to be ruling over nothing.”

By Catherine Schaer

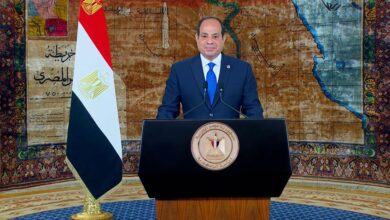

IMAGE: Protests in Lebanon are ongoing: A masked demonstrator outside Lebanon’s central bank in Beirut. AmroAA/AFP via Getty Images