As a virulent avian influenza outbreak continues to spread across the Midwestern United States, some egg-dependent companies are contemplating drastic steps – importing eggs from overseas or looking to egg alternatives.

A spokeswoman for Archer Daniels Midland Co said that as egg supplies tighten and prices rise, the food processing and commodities company has received numerous inquiries from manufacturers about the plant-based egg substitutes it makes.

With a strong dollar bolstering the buying power of US importers, some companies are scouting for egg supplies abroad.

"The US has never imported any significant amount of eggs, because we've always been a very low-cost producer," said Tom Elam of FarmEcon, an agricultural consulting company. "Now, that's no longer the case."

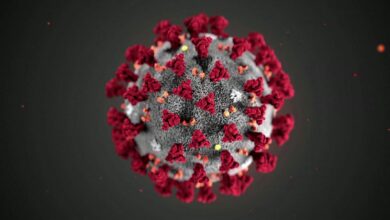

The United States is grappling with its biggest outbreak of bird flu on record, which has led to the culling of 40 million birds. The virus has been confirmed on commercial farms and backyard flocks in 16 US states and in Canada.

The highly infectious virus has not crossed over to humans in the United States, as it did in Asia following a 2003 outbreak, but transmission to humans is possible, according to the Centers for Disease Control and Prevention.

An industry group representing US bakers began pushing the US Department of Agriculture and Congress this week to speed up approvals for egg imports.

"We have members whose egg suppliers are already cutting back how much they'll receive in the next few weeks, while others are not getting any," said Cory Martin, vice president of government relations for the American Bakers Association. "They're looking for eggs everywhere. And the problem is, too, there's not enough egg substitute available right now to make up for the demand."

Still, companies wanting to import eggs may have to look far afield.

"Canada is short on eggs and has been buying heavily from the US for the last several years," said Rick Brown, a senior vice president of Urner Barry, a commodity market analysis firm. "Mexico has been dealing with its own outbreaks of avian influenza, so they're banned from importing into the US The logical place people will be looking now would be Europe."

Avril, a farmer-controlled agri-food group that owns France's largest egg brand, Matines, said it has seen an increase recently in demand from the United States and elsewhere in the Americas and plans to start making shipments to the Americas in June.

A spokesman for Avril told Reuters on Friday most of its exports would be heading to Mexico, though he noted that shipments to the United States were a possibility.

Economic bite

Exporting eggs into the United States from Europe will not be easy. Regulatory differences mean European Union egg producers must seek an individual license to export and sometimes change procedures to bring safety standards into line.

But it is still an attractive business opportunity.

The French embassy in Washington is helping one French egg company start the process to obtain an export certificate, a French farm ministry spokesman said.

The Dutch also are positioning themselves as an egg exporter to the United States too, French egg industry group SNIPO said.

"The bird flu epidemic developing in the US means it is necessary to start discussions as quickly as possible to benefit from opportunities in this market," SNIPO said in an emailed statement, adding that French authorities had not responded as swiftly as their Dutch counterparts.

Prices soar

Meanwhile, companies sticking with egg suppliers closer to home are facing sharply higher prices as a result of the outbreak. Nearly 30 percent of US breaker eggs – which includes liquid, dried or frozen eggs used by food manufacturers – has disappeared due to the outbreak, according to Martin and federal data.

The outbreak has led to a sharp uptick in the wholesale price of such eggs, from 63 cents a dozen in late April, when the first egg-laying flock was reported infected, to $1.83 a dozen this week, Brown said.

The wholesale price of "shell eggs," typically sold in cartons at grocery stores, has also risen, from $1.19 a dozen in late April to $2.03 a dozen this week, Brown said.

Nevertheless, some food makers are turning to the more expensive shell eggs to supplement supplies, although that means an additional cost to send the eggs to a breaking facility that will crack the shells, Elam said.

Analysts at Goldman Sachs predict consumers will ultimately spend an additional $7.5 billion to $8 billion because of the egg supply squeeze.

Nestlé SA – which uses eggs for some of its Dreyer's, Edy's and Häagen-Dazs ice cream products – said it is braced for shortages and working with suppliers to help protect hens.

Dunkin' Brands Group Inc told Reuters it will leave it up to franchisees to decide whether to swallow the cost hikes they're seeing or pass them on to consumers.

A matter of life or death

For some companies, having an adequate supply of fertilized eggs can be a matter of life or death. Some vaccine makers, including Merck & Co Inc, maintain their own hen flocks to produce eggs used for incubating vaccines that protect against diseases such as measles and mumps.

Merck said it is taking no chances with its chicken flocks as avian influenza continues to spread – security is tight around the birds, and the health of the hens is continuously monitored.

Sanofi Pasteur, the vaccines division of Sanofi, said it too is keeping close tabs on the outbreak – particularly with the state agriculture department in Pennsylvania, home to some of its suppliers and the fourth-largest US egg-laying flock. So far, no avian influenza cases have been identified there.

"We continue to maintain preventive measures for our egg supply system, including biosecurity and physical security procedures, to provide our suppliers with protection from being affected by this or any avian outbreak," the company told Reuters in a statement.

And GlaxoSmithKline Plc told Reuters it is reinforcing biosafety standards at more than 30 Canadian egg-laying farms that are dedicated to producing eggs for the company’s human flu vaccines.

The company has more egg supplies than it needs for its flu vaccine production in Canada and Germany, a spokeswoman said.

But as the bird flu outbreak spreads in the United States, she added, “we are monitoring the current situation closely and have alerted all of our supply farms.”

(This version of the story corrects French industry group name, shows it referred to Dutch interest, not farm ministry spokesman)