DUBAI, July 28 (Reuters) – United Arab Emirates’ biggest lenders First Abu Dhabi Bank (FAB.AD) and Emirates NBD (ENBD.DU), posted double-digit percentage gains in quarterly net profit on Wednesday, as impairments fell amid a recovery from the pandemic while fee and commission income rose.

UAE banks are benefiting from an economic recovery from last year’s pandemic-led lockdowns which will see the Gulf’s second-largest economy grow 3.1% this year, the International Monetary Fund has said, versus a 5.9% contraction in 2020.

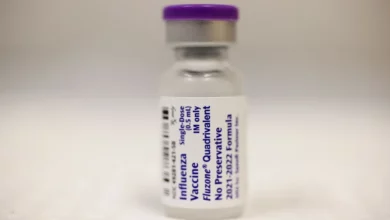

“The UAE economy has remained open thanks to the speed and success of the UAE’s vaccination programme,” Hesham Abdulla al- Qassim, vice chairman of Emirates NBD, said.

“With 70% of the population fully vaccinated, and with one of the highest testing rates globally, the UAE continues to be a safe and attractive destination for residents and visitors.”

FAB posted a net profit of 2.879 billion dirhams ($783.87 million) for the quarter to June 30, up from 2.4 billion a year earlier.

Emirates NBD posted a net profit of 2.46 billion dirhams, up from 2.01 billion as both lenders beat analysts expectations.

Smaller rival Dubai Islamic Bank (DISB.DU), however, posted a flat quarterly net income.

FAB’s net impairment charges fell 36% to 677 million dirhams while Emirates NBD’s almost halved to 851 million dirhams.

FAB Group CFO James Burdett said in a statement impairment charges were lower due to significantly improved economic conditions.

FAB’s net fee and commission income jumped by more than a fifthwhile Emirates NBD posted a 38% rise.

Both lenders recorded lower net interest income reflecting weak global interest rates.

($1 = 3.6728 UAE dirham)

Reporting by Saeed Azhar; editing by Tom Hogue and Jason Neely