ISTANBUL, Dec 10 (Reuters) – Turkey’s central bank is expected to cut its policy rate by 100 basis points to 14% next week, a Reuters poll showed on Friday, forging on with an easing cycle that has sent the currency crashing to record lows and inflation soaring above 21%.

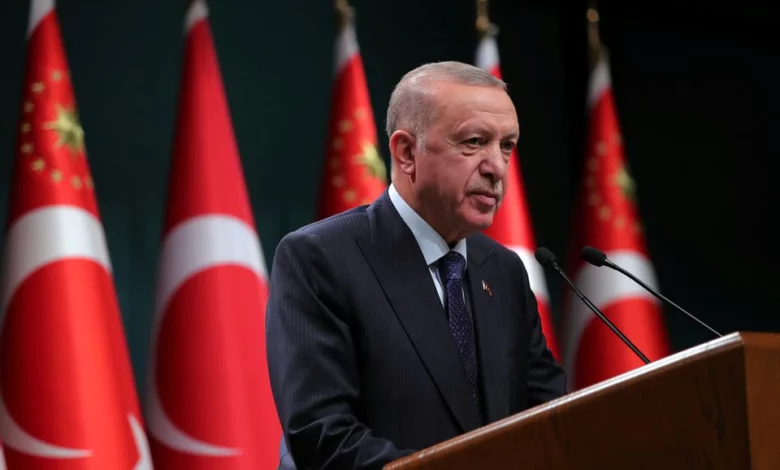

The central bank has already cut its policy rate by 400 basis points to 15% since September, delivering the stimulus long sought by President Tayyip Erdogan, whose heavy influence on policy has eroded the central bank’s credibility.

Twelve of 13 economists polled expected the bank to cut its key interest rate on Dec. 16 with estimates ranging from 25 to 200 basis points. One economist expected the bank to hold steady and none predicted a hike.

The currency is down 31% since the beginning of November, upending household budgets, eroding incomes and driving import inflation. The policy has drawn widespread criticism from economists and opposition politicians who call it reckless.

Yet Erdogan has repeatedly defended the low-rate policy over the last three weeks as necessary to boost growth, exports and credit. The government, regulators and the banks association have all rallied around what he calls a new economic model.

On investor conference calls this month, Central Bank Governor Sahap Kavcioglu signalled the easing would likely pause in January after one more cut this month. read more

One participant told Reuters that the bank, in response to a question, said the chances of holding rates at 15% in December had increased due to the selloff.

Barclays said authorities are determined to continue easing since they consider inflation – which hit a three-year high of 21.31% last month – transitory, and they see lira volatility as irrational.

“One critical question, in our view, is what is a low interest rate – 12%, 8% or 5%? We expect a 200-point cut (in) December followed by a 100-point cut in January 2022,” Barclays said in a note.

It added that “excessive” currency volatility makes any medium-term prediction quite difficult.

The poll also showed an expectation that the policy rate will stand at 12% at the end of 2022, according to the median of eight respondents.

Economists generally see inflation shooting toward 25% by the end of this year and toward 30% next year, due in part to the currency plunge.

Turkey’s real interest rate is deeply negative, a red flag for investors and savers, including Turks who have flocked to hard currencies.

Erdogan has ousted three central bank governors in 2-1/2 years and replaced many of its other orthodox policymakers. This month he appointed as finance minister Nureddin Nebati, a strong supporter of rate cuts. read more