LONDON, Dec 22 (Reuters) – Turkey’s radical new plan to support the lira and discourage dollarisation comes with obvious potential costs, one of Fitch’s top sovereign analysts said on Wednesday, adding time would be needed to see if it worked or not.

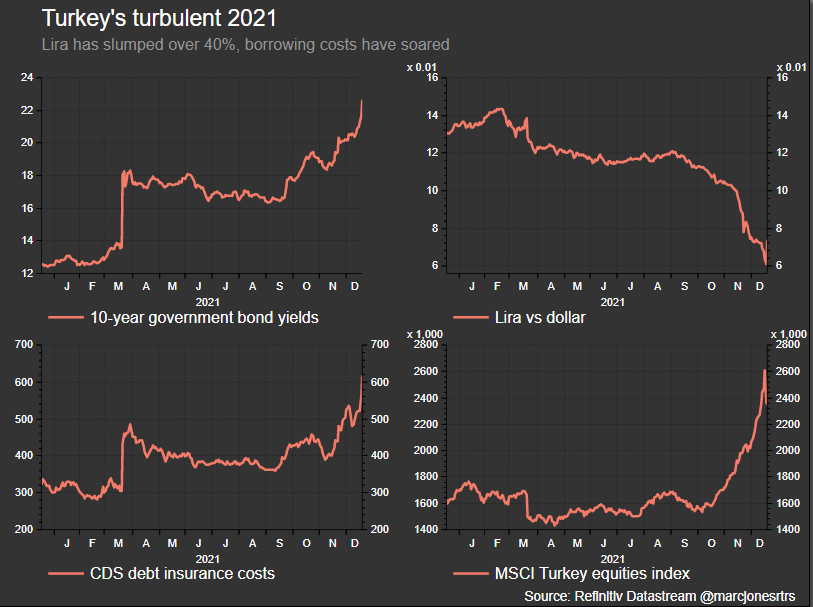

Fitch put Turkey’s BB- rating on a downgrade warning earlier this month as a slump in the lira threatened to run out of control.

On Monday the country’s president Tayyip Erdogan, announced measures to try and halt the rout, including hand outs if inflation exceeds Turkish banks’ savings rates, making it tax-free to hold the government’s domestic bonds and increasing private pension contributions. read more

“Ultimately, it is about confidence in the currency,” Fitch’s Head of Emerging Europe Sovereign Ratings, Paul Gamble, told Reuters, referring to the new plan to guard local currency savings against major FX market falls. read more

“Clearly there is a new potential liability for the sovereign balance sheet,” he added. “But if this approach works… there could no liability.”

He pointed out too that Turkey has far stronger finances than other big BB- rated emerging market heavyweights such as Brazil and South Africa. Its debt-to-GDP ratio is expected to end the year at 47%. The average for BB- countries is 57%, South Africa’s is 71% and Brazil’s is 81%.

Its debt-to-fiscal revenue ratio – the amount it has borrowed compared to the tax money the government brings in each year – is also far stronger at 144.5% vs the BB average of 225%.

“We really need to take stock and understand the effect of this new interest rate tool,” Gamble said.

“There is some degree of fiscal space for this,” he explained. “But in the run up to the election (expected in 2023), if we see more use of the public balance sheet, this would be concerning against a backdrop where monetary policy credibility has been eroded.”

//