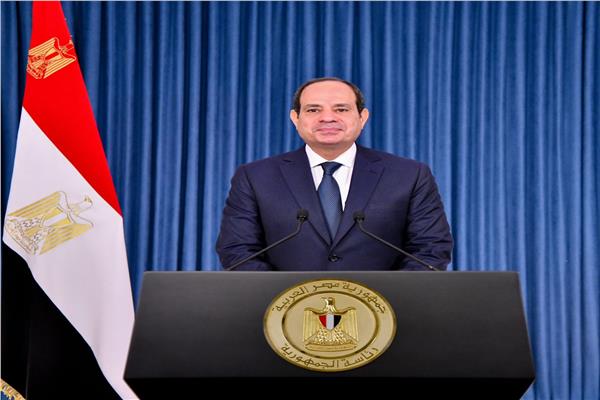

CAIRO, Nov 30 (MENA) – President Abdel Fattah al-Sisi directed the launch of the second package of tax facilitations, emphasizing the importance of continuing to modernize the tax system and building trusted, credible relations with taxpayers, while improving services and providing additional incentives to reinforce confidence among investors.

During his meeting with Prime Minister Mostafa Madbouly and Finance Minister Ahmed Kouchouk on Sunday, Sisi reviewed the features of the second tax facilitation package, titled “Supporting and Encouraging Tax Compliance,” forming part of a four-phase strategy.

The strategy’s first phase aims to open a new page with taxpayers and restore trust, while the second focuses on incentivizing compliant taxpayers through simplified procedures, digitalization, wider tax coverage, and ensuring continued compliance, Presidential Spokesman Mohamed El Shennawy said in a statement following the meeting.

The finance minister said the second package targets all compliant taxpayer segments, offering incentives and facilitations that reinforce voluntary compliance, support business growth and competitiveness, and ensure taxpayer rights and liquidity for individuals and companies.

He reviewed progress on the broader investment-oriented tax reform track under the “Trust Partnership” with the business community, noting the success of the first phase.

Kouchouk said 400,000 old cases were voluntarily closed, 650,000 new or amended returns were submitted with additional taxes of LE 78 billion, and new reported business volumes exceeded one trillion LE.

He added that the second package includes enhancing VAT refund efficiency, establishing premium tax support centers, and introducing new incentives for compliant taxpayers, in addition to reforms responding to the needs of businesses, taxpayers, accountants and tax experts.

The minister also reviewed preparations for implementing real estate tax facilitations, noting the reform aims to ease burdens, simplify procedures, advance digitalization, and address shortcomings identified during implementation.

Planned measures include simplifying tax declarations, extending valuation cycles to seven years, raising exemptions for primary residences, suspending or waiving tax during crises, writing off dues and penalties under specific conditions, streamlining appeals, enabling electronic payment, and capping late-fee penalties, he added.

The spokesman said the meeting also reviewed latest fiscal and economic performance indicators and efforts to restore investor confidence.

The finance minister said economic activity remains on a positive trajectory, with private investments growing 73 percent in the last fiscal year and balanced indicators supporting stronger investor confidence.

He reaffirmed commitment to maintaining a strong primary surplus to allow expanded investment in human development and social protection, while supporting manufacturing and exports.

Kouchouk outlined the joint customs-system development plan coordinated with the Ministries of Finance and Investment and Foreign Trade. The plan responds to the needs of producers and chambers of commerce and aims to remove obstacles facing businesses, boost exports and competitiveness, and advance customs procedures. Its pillars include reducing clearance times, digitalization and automation, and strengthened oversight to curb smuggling. Planned measures include unified and expedited inspection systems, expanded pre-clearance, electronic payments, and enhanced training for customs personnel.

He also reviewed efforts to reduce the public-budget debt-to-GDP ratio as a national priority, noting strong private-sector confidence reflected in major investment deals such as Ras El Hekma and Alam El Roum.

President Sisi underscored the need to build on ongoing improvements in economic indicators and expand private investment to solidify the private sector’s role in driving growth.

He also emphasized investment in human capital through innovative programs and training to support performance and economic competitiveness.

The president directed full implementation of digital transformation across all Ministry of Finance functions, including customs and tax systems, and stressed the need to maintain strong governance of all procedures. (MENA)