The instant payment network, InstaPay Egypt, has released a new update to its fees and tariffs.

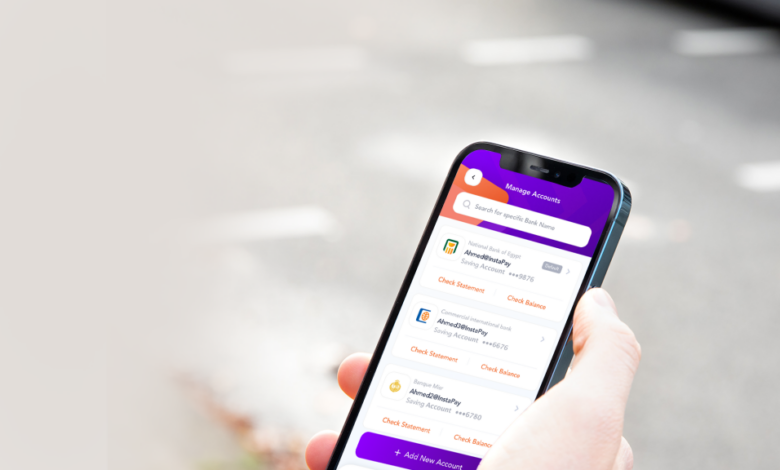

InstaPay is a modern financial service offered by banks to facilitate instant money transfers between bank accounts.

When will the new fees be applied?

Egyptian banks are scheduled to begin imposing fees on InstaPay transfer services, starting April 1.

These fees include the following:

- Money transfers: A fee of 0.1 percent of the transaction value is charged, with a minimum of one LE and a maximum of LE 20 per transaction.

- Non-financial services: These include balance inquiries and mini-statement requests. A fee of LE 0.5 per request will be charged, with users being granted 10 free requests per month per mobile number.

New service fees

InstaPay has set new fees for transfers through its app at 0.1 percent of the transaction value, with a minimum of 50 piasters and a maximum of LE20 per transaction.

The app will allow 10 free balance or mini-statement inquiries per month for each customer, with a fee of 50 piasters applied for each additional inquiry.

This step comes in light of the significant expansion from the InstaPay app since its launch in April 2022, where transfer and inquiry services have been provided free of charge for the past three years.

Daily withdrawal limit

The Central Bank of Egypt recently announced withdrawal limits for the InstaPay app, after amending the maximum daily and monthly transaction limits and the maximum single transaction limit on the digital app.

Withdrawal limits from InstaPay Egypt app vary between a maximum single transaction withdrawal of up to LE 70,000 and a maximum daily transaction limit of LE 120,000.

Over the course of a month, withdrawals using the InstaPay app must not exceed LE 400,000, according to a circular published on the Central Bank’s official website.

Edited translation from Al-Masry Al-Youm