Economists have touched on the various advantages the Egyptian economy may receive from the currency swap agreement signed on Thursday with the UAE.

Egypt and the UAE signed an agreement that allows the two parties to exchange the Egyptian pound and the UAE dirham, with a nominal value of up to LE42 billion or five billion AED.

According to one economist, the agreement provides Egypt with its needs for services and goods, while another said that it reduces pressure on the US dollar demand in Egypt.

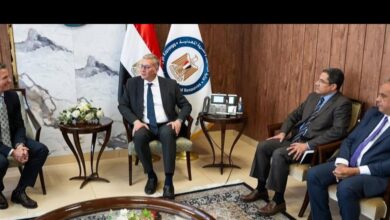

It comes under efforts to strengthen close relations between the two countries at all levels, which contributes to facilitating and increasing the volume of trade exchange between them, the Emirates News Agency quoted the Governor of the Central Bank of Egypt, Hassan Abdullah as saying.

And the Governor of the Central Bank of the UAE, Khaled Mohamed Balama, stated that the agreement reflects the depth of bilateral relations between both nations.

It constitutes an important opportunity to develop the economic and financial markets between the two sides in all fields, he said, which reflects positively on the commercial, investment and financial sectors and enhances financial stability.

What is the economic impact of exchanging the Egyptian pound with the Emirati dirham?

The economic returns to Egypt from the Egypt-UAE agreement were explained by economic expert Rashad Abdo, the President of the Egyptian Forum for Economic and Strategic Studies, in exclusive statements to Al-Masry Al-Youm.

According to Abdo, the currency swap agreement kills three birds with one stone.

The agreement provides the Egyptian people’s needs for goods and services while relieving pressure on the US dollar, and allowing the export of local products by operating factories, increasing productivity and most importantly, saving foreign currency, he said.

“In this way, we will increase our exports and provide our needs without paying any foreign currencies,” Abdo continued.

This step will also require providing production suitable for export at a low price and with high efficiency, which is considered appropriate preparation before the activation of the BRICS currency, he added.

Egypt had previously succeeded in a similar experience with China about five years ago, during which Egypt exchanged $2.62 billion in the national currency, instead of the US dollar.

“Likewise in the UAE agreement, in this case we will not need dollars from the central bank,” Abdo explained.

“If this experience with the UAE has proves to be a success, it can expand to include other countries.”

The currency swap agreement will help Egypt reduce the burden of importing in US dollar, banking expert Ahmed Shawqi told Al-Masry Al-Youm.

Egypt’s exports to the UAE amounts to about $1.8 billion, while imports amount to $2.9 billion, he added.

The decision will contribute to reducing the trade balance deficit within the balance of payments, by saving about $1.4 billion dollars, due to reducing the burdens on all goods.

Shawqi explained that, for example, Egypt will not need to pay for fuel and petroleum imports in US dollar.

The decision is useful for reducing pressure on the dollar by creating bilateral transactions in other currencies, he added.

It is a general trend for countries around the world now to dispense with dealing in the US dollar, and to diversify between a basket of different currencies, reducing the dominance of the US dollar as a currency, Shawqi noted.

The currency swap agreement with the UAE is considered an appropriate prelude before Egypt’s entry into the BRICS bloc, as part of a set of steps with which the government addresses the crisis of foreign exchange, he said.

Edited translation from Al-Masry Al-Youm