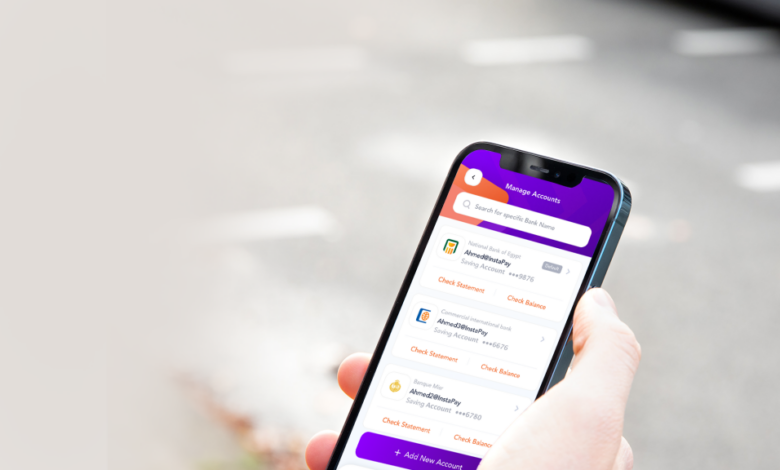

The Deputy Assistant Governor of the Central Bank of Egypt (CBE) for Banking Operations and Payment Systems Ehab Nasr announced on Friday that more services will be launched on InstaPay soon – including cash withdrawal through ATMs.

The Central Bank on Thursday chose to continue free InstaPay application transactions, and cancel the fee-imposing scheme that was scheduled to take effect starting next year.

The CBE’s Board of Directors issued a set of decisions including exempting customers from all expenses and commissions related to bank transfer services made through internet and mobile banking in Egyptian pounds.

The decisions also included exemption from all expenses and commissions related to transfer services for customers of InstaPay.

The CBE said that these decisions will take effect as of January 1, and come as a continuation of its efforts to motivate citizens to use digital financial services, and benefit from the advantages it provides to complete financial services quickly, anywhere and at any time.

This will contribute to transforming Egypt into a society less dependent on banknotes, and enhances financial inclusion.

The CBE indicated that InstaPay – which was launched in April 2022 – is one of the most important infrastructure projects for payment systems sponsored by the bank.

It aims to be an integrated alternative to cash payments that provide all transfer services to customers in real-time, seven days a week, 24 hours a day.

The bank explained that the system witnessed a significant increase in the volume of transactions, reaching 404 million transactions worth LE815 billion this year through the InstaPay application and the bank’s electronic channels, with over 6.5 million customers.

Banking expert Mohamed Abdel-Aal explained that the bank’s decision supports the state’s move towards a creating a society less dependent on banknotes, which in turn will increase volume of non-cash payments and attract more customers.