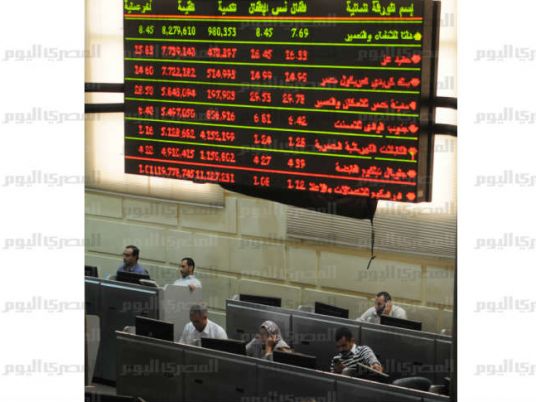

Egypt's benchmark stock index closed moderately higher on Tuesday, the third consecutive day of gains, while the trading of shares of several major blue chip companies was temporarily halted after they triggered safeguards aimed at cooling the market.

The Egyptian Exchange's benchmark EGX30 index closed 3 percent higher. The index had closed up 0.75 percent on Monday, giving back much of the gains it recorded earlier in the day as buyers stepped back to reassess the market. The gains over the week have pared down its year-to-date losses to around 24 percent.

The exchange's acting chairman, Mohammed Abdel-Salam, said the market has been performing well since it was relaunched on 23 March, nearly two months after trading was halted amid protests that ousted former President Hosni Mubarak.

Abdel-Salam said that officials would meet later Tuesday to discuss when to lift or ease measures enacted ahead of the exchange's relaunch, such as "circuit-breakers" under which trading would be suspended for 30 minutes if the broader EGX100 index shifts by more than 5 percent. Another halt would take place on a 10 percent shift.

"Maybe we will not stop all the circuit breakers, or these procedures, but maybe it will return back to normal, step by step," Abdel-Salam said at a news conference.

Traders said institutional investors remained particularly active in the market, with Egyptian investors still clinging to the sidelines amid continued volatility in the market and a general sense of disquiet about the course of the country following Mubarak's ouster in February.

Egypt's military rulers said Monday that the much-reviled emergency laws that have been in force for over 30 years in the country would be lifted by the time elections are held in September. Already, Egyptians have voted in a referendum on proposed constitutional amendments, a vote seen as a milestone in a country where such events were rigged in favor the ruling party.

But hanging over the market are investigations involving former regime officials and wealthy businessmen who had links to the ousted president and his confidants. Companies in which these individuals either held posts, or had holdings, have either taken big hits on the exchange, or have had their shares see little interest.

On Tuesday, Ezz Steel, whose chairman is among the most high profile former party officials facing charges, saw its shares stop trading for 30 minutes after it quickly hit its 10 percent limit down, traders said. Another company with links to a former official, Palm Hills Development, also saw trading in its shares temporarily halted for the same reason, traders said.

Ezz's shares were trading at 10.51 pounds, down 9.55 percent. Ezz shares accounted for the highest turnover so far during the day, said Mostafa Abdel-Aziz, a senior broker with Mideast investment bank Beltone Financial.

The company's shares "were trying to absorb the selling pressure," said Abdel-Aziz.

Orascom Telecom shares was up 5.2 percent higher, at 4.43 pounds, according to Zawya.com, a financial data provider.

The Cairo-based telecom giant said Tuesday it had secured regulatory approval for an April 14 shareholder meeting to approve increasing its capital to 14 billion pounds (US$2.35 billion), splitting the company ahead of the planned purchase of its parent firm, Wind Telecom, by Russian mobile phone service operator Vimpelcom. The meeting would also discuss a refinancing plan for its debt, OT said in a statement posted on its Web site.