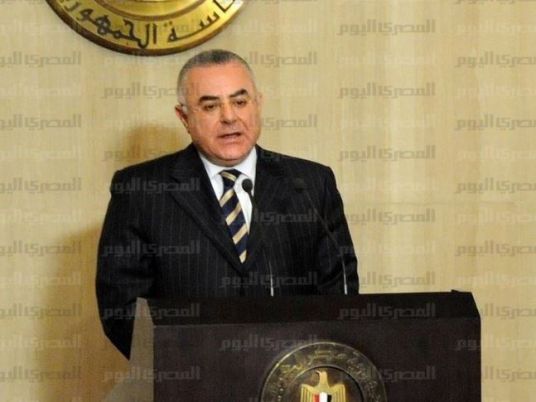

Egypt's central bank governor Hisham Ramez said the once-flourishing currency black market "will end soon" as the bank's moves to narrow the gap between the official and black market rates begin to bear fruit.

For more than two weeks the central bank has let the Egyptian pound weaken for the first time in six months, from its long-time rate of 7.14 pounds per dollar to a new low of 7.53 in Monday's auction.

Ramez said on Monday the government and banks were well positioned to absorb the black market into the formal market, and dismissed concerns the elimination of the unofficial market would lead to dollar shortages.

"Egypt does not have a dollar problem … Egypt imports 60 billion dollars and receives 18 billion more in remittances from Egyptians abroad," Ramez said during a meeting with the Egyptian expatriate community in Kuwait.

Egypt has also received billions of dollars in aid from Gulf allies in the past year-and-a-half in the form of cash deposits in its central bank, as well as petroleum products.

Though the black market largely shrugged off the initial official depreciations, the introduction of a wider band for banks to trade dollars around the official rate last week appeared to have an effect, with some traders expressing concern about the viability of the black market.

The rate between the official and unofficial rates has begun to narrow after months of widening, though the rates quoted on the black market fluctuate daily, making it difficult to assess the central bank's success.

Monday's two piaster weakening at a central bank dollar auction was the tenth official depreciation.

The rates at which banks are allowed to trade dollars are determined by the results of central bank sales, giving the bank effective control over official exchange rates.

The central bank governor said in November the black market would be eliminated within six months to a year.